Nike représente une opportunité prometteuse de croissance des dividendes

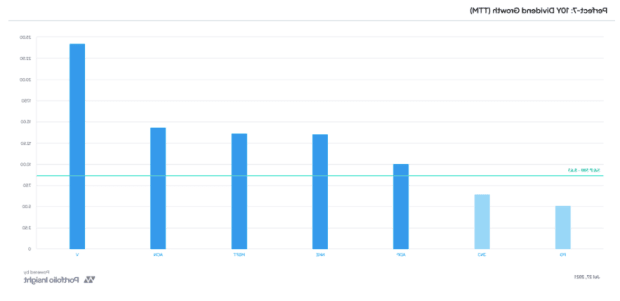

Nike Inc. (NKE) is home to some of the biggest names in apparel and footwear. Its exposure to the athleisurewear trend combined with its stellar digital operations and ample pricing power underpins Nike’s bright growth outlook. Adjusted for stock splits, Nike has pushed through substantial increases in its dividend in recent years (including a sizable boost in November 2021). We expect that Nike’s great dividend growth track-record will continue in earnest going forward, aided by its rock-solid financial position.

Table des matières

Points forts de l’investissement

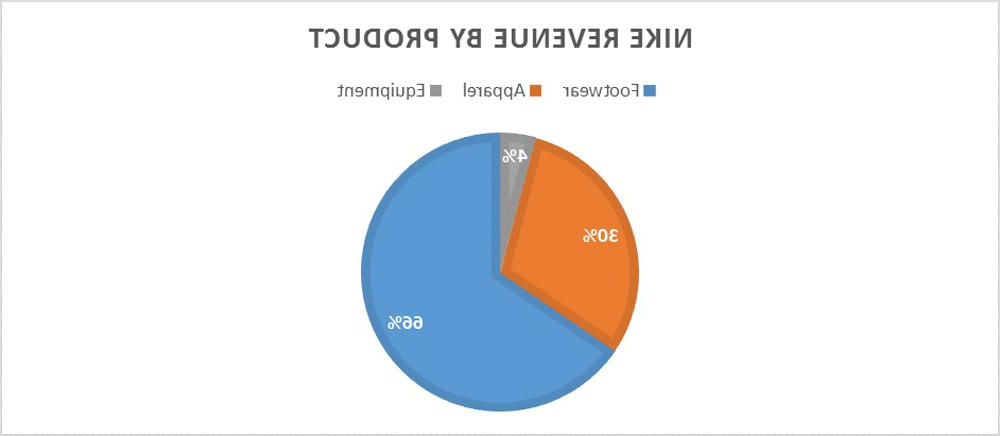

Nike focuses its ‘Nike Brand’ product offerings in the following categories: Running, Basketball, Football (Soccer), Men’s Training, Women’s Training, Nike Sportswear (sports-inspired lifestyle products), Action Sports, Gold, and the Jordan Brand. The breadth and depth of its product portfolio have translated into consistently strong results.

Back in June 2017, Nike announced its ‘Consumer Direct Offense’ initiative which aimed to aggressively grow its direct-to-consumer (‘D2C’) sales through digital channels such as mobile apps and websites run by Nike. Over the following years, that program has been a home run. Success on the D2C and digital front underpins Nike’s promising revenue growth and margin expansion outlook over the long haul.

Revue financière

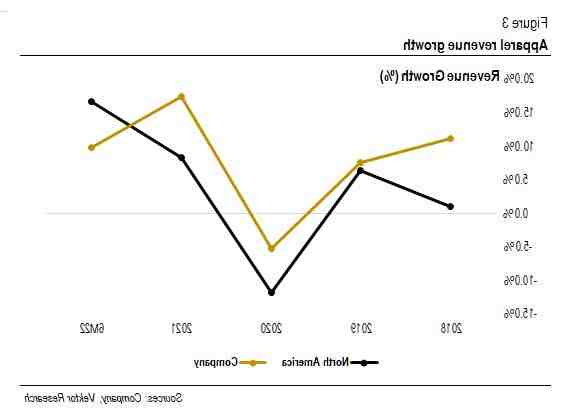

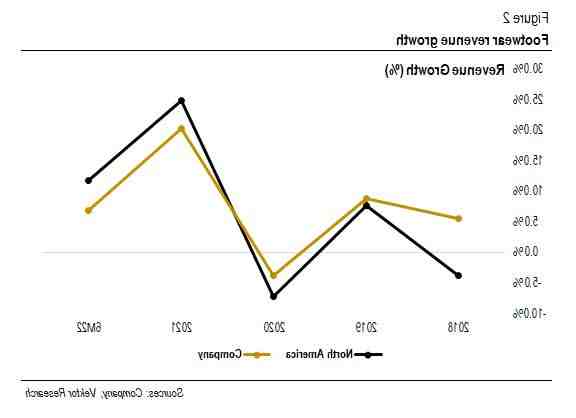

Even in the face of major headwinds from the coronavirus (‘COVID-19’) pandemic, Nike put up tremendous financial performance. Please note the company’s fiscal year ends in May. In fiscal 2021, Nike’s GAAP revenues grew by 19% year-over-year to $44.5 billion while its GAAP gross margin expanded by ~140 basis points, hitting ~44.8%. Success at its D2C and digital operations were key here as Nike was able to continue meeting robust demand for its offerings as many physical stores temporarily closed their doors, while using its pricing power to maintain and grow its margins. Its ‘NIKE Direct’ sales were up 32% year-over-year in fiscal 2021 as its ‘NIKE Brand Digital’ sales surged higher by 64%. Nike’s apparel, equipment, and footwear offerings all posted solid sales growth in fiscal 2021.

Due primarily to the pandemic, Nike’s operating expenses fell year-over-year in fiscal 2021. Reduced operating expenses, revenue growth, and gross margin expansion offset a higher corporate income tax bill and enabled Nike to more than double both its GAAP operating income and GAAP net income fiscal 2021 on a year-over-year basis. Its GAAP operating margin climbed higher by ~725 basis points in fiscal 2021 versus fiscal 2020 levels, hitting ~15.6%.

This impressive performance translated into stellar cash flow performance. Nike generated $6.0 billion in free cash flow, defined as net operating cash flow less capital expenditures, in fiscal 2021. That was up sharply from the $1.4 billion in free cash flow Nike generated the prior fiscal year. Additionally, Nike spent $1.6 billion covering its total dividend obligations and another $0.6 billion buying back its common stock in fiscal 2021, activities that were fully covered by its free cash flows.

Nike has been facing headwinds of late due to manufacturing and other supply chain hurdles in Southeast Asia. Its GAAP revenues grew by just 1% year-over-year in the second quarter of fiscal 2022 (period ended November 30, 2021) though its GAAP gross margin still exploded higher by ~280 basis points during this period. Once again, strength at its D2C and digital operations impressed. NIKE Direct sales were up 9% year-over-year and its NIKE Brand Digital Sales grew by 12%. The company’s pricing power enabled it to offset various inflationary headwinds and preserve its margins. Nike’s marketing spend has normalized in more recent fiscal quarters, which is weighing negatively on its bottom-line performance, though its GAAP net income still grew by 7% year-over-year in the fiscal second quarter.

We appreciate that Nike exited the fiscal second quarter with a $5.7 billion net cash position (inclusive of short-term investments and short-term debt). This financial strength enabled Nike to announce it was raising its quarterly dividend by 11% sequentially in November 2021. Going forward, we expect Nike will continue to steadily boost its dividend while repurchasing sizable chunks of its stock. During the first half of fiscal 2022, Nike generated $3.5 billion in free cash flow and spent $0.9 billion covering its total dividend obligations and another $1.7 billion buying back its common stock. Once again, both activities were fully covered by its free cash flows.

Key line items concerning’s Nike’s free cash flow performance during the first half of fiscal 2022 have been underlined in red by the author Nike – 10-Q SEC filing covering the second quarter of fiscal 2022

Key line items concerning’s Nike’s free cash flow performance during the first half of fiscal 2022 have been underlined in red by the author

Nike – 10-Q SEC filing covering the second quarter of fiscal 2022

Analyse du profit économique

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital [‘ROIC’] with its weighted average cost of capital [‘WACC’]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread.

From fiscal 2018-2020, Nike’s return on invested capital (without goodwill) stood at 34.2%, which is above the estimate of its cost of capital of 8%. In our view, Nike is a tremendous generator of shareholder value. In the upcoming graphic down below, we show the probable path of ROIC in the fiscal years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate.

Nike has historically been a tremendous generator of shareholder value, and we expect that will continue being the case going forward Valuentum Securities

Nike has historically been a tremendous generator of shareholder value, and we expect that will continue being the case going forward

The upcoming graphic down below highlights how we calculated Nike’s estimated WACC.

An overview of how Valuentum Securities calculated Nike’s estimated weighted average cost of capital Valuentum Securities

An overview of how Valuentum Securities calculated Nike’s estimated weighted average cost of capital

Analyse de l’évaluation

We think Nike is worth $133 per share under our « base » case scenario with a fair value range of $106-$160 (the upper rung represents our « bull » case scenario and the lower rung represents our « bear » case scenario), derived through our rigorous discounted free cash flow analysis process. In short, we forecast Nike’s future free cash flows out into perpetuity and discount those cash flows at the appropriate rate (its estimated WACC), then take its balance sheet considerations into account. The near-term operating forecasts used in our enterprise cash flow models, including revenue and earnings forecasts, do not differ much from consensus estimates or management guidance.

Our valuation model reflects a compound annual growth rate in the low double-digits over the coming years and projected average operating in the mid-teens. Beyond Year 5, we assume Nike’s free cash flows will grow at an annual rate of 4.6% for the next 15 years and 3% in perpetuity. For Nike, we use an 8% weighted average cost of capital to discount future free cash flows.

An overview of the key valuation assumptions used by Valuentum Securities to derive Nike’s fair value estimate Valuentum Securities

An overview of the key valuation assumptions used by Valuentum Securities to derive Nike’s fair value estimate

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate Nike’s fair value at about $133 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the upcoming graphic down below, we show this probable range of fair values for Nike. We think the firm is attractive below $106 per share (the green line), but quite expensive above $160 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

The top end of Nike’s fair value estimate range sits at $160 per share of NKE Valuentum Securities

The top end of Nike’s fair value estimate range sits at $160 per share of NKE

Réflexions finales

Nike is a stellar enterprise. Its balance sheet is pristine, the company is a tremendous generator of free cash flow and shareholder value, and its pricing power continues to impress. We appreciate how its D2C and digital operations are supporting both Nike’s sales and margin performance, and see room for additional upside going forward. Shares of NKE yield a modest ~0.8% as of this writing, though we forecast that Nike’s per share dividend will grow at a robust pace over the coming years.

We offer subscriptions and exclusive newsletters. Visit our website at www.valuentum.com for more information. Valuentum is an independent investment research publisher, offering premium equity reports and dividend reports, as well as commentary across all sectors/companies, a Best Ideas Newsletter (spanning market caps, asset classes), a Dividend Growth Newsletter, modeling tools/products, and more. Valuentum is based in the Chicagoland area. Valuentum is not a money manager, broker, or financial advisor. Valuentum is a publisher of financial information. Please read our Disclaimer that applies to all articles published on Seeking Alpha: http://www.valuentum.com/categories/20110613. Follow us on Twitter: @Valuentum

Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Callum Turcan does not own shares in any of the securities mentioned above. Ratings and data as of January 18. This article is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither Valuentum nor any of its affiliates own any securities mentioned in this article. The household of Valuentum’s President Brian Nelson owns one share of Nike. Contact Valuentum for more information about its editorial policies.

Quand ne devez-vous pas utiliser le DCF ?

Thus, DCF analysis is perhaps best considered over a range of values arrived at by different analysts using varying inputs. Also, since the very focus of DCF analysis is long-term growth, it is not an appropriate tool for evaluating short-term profit potential.

When should DCF not be used? 1) No one ever uses a DCF to value a startup company unless your startup is some kind of heavy infrastructure company – solar power, oil production, logistics etc. 2) The equity value you get from a DCF is Pre-Money. To this Pre-Money you will add the new cash from investors and hence Post Money = Pre Money New Cash.

Lequel des éléments suivants n’est PAS une méthode d’actualisation des flux de trésorerie ?

| Q. | Which one of the following is not a discounted cash flow technique: |

|---|---|

| B. | irr |

| C. | npv |

| D. | pi |

| Answer» a. arr |

Quelles sont les limites du DCF ?

The main Cons of a DCF model are:

- Requires a large number of assumptions.

- Prone to errors.

- Prone to overcomplexity.

- Very sensitive to changes in assumptions.

- A high level of detail may result in overconfidence.

Tesla verse-t-il des dividendes ?

Tesla has never declared dividends on our common stock. We intend on retaining all future earnings to finance future growth and therefore, do not anticipate paying any cash dividends in the foreseeable future.

How often does Apple pay a dividend? Dividend Yield For dividend investors, stock price appreciation is usually a secondary priority to the dividend income. A stock’s dividend yield is the annual dividend divided by the stock’s trading price. Apple’s quarterly dividend as of the second quarter of 2021 was $0.22 per share.

Combien coûte un dividende d’Apple ?

| Ex/EFF DATE | TYPE | CASH AMOUNT |

|---|---|---|

| 05/08/2020 | CASH | $0.82 |

| 02/07/2020 | CASH | $0.77 |

| 11/07/2019 | CASH | $0.77 |

| 08/09/2019 | CASH | $0.77 |

Do Apple pays dividend?

(AAPL) will begin trading ex-dividend on November 05, 2021. A cash dividend payment of $0.22 per share is scheduled to be paid on November 11, 2021. Shareholders who purchased AAPL prior to the ex-dividend date are eligible for the cash dividend payment. This marks the 3rd quarter that AAPL has paid the same dividend.

Quel est le dividende d’Amazon ?

Amazon (NASDAQ: AMZN) does not pay a dividend.

What is Amazon’s dividend per share? Historical dividend payout and yield for Amazon (AMZN) since 1971. The current TTM dividend payout for Amazon (AMZN) as of January 21, 2022 is $0.00. The current dividend yield for Amazon as of January 21, 2022 is 0.00%.

Amazon verse-t-il des dividendes ?

Amazon’s lack of a dividend certainly has not hurt investors to this point, as Amazon has been a premier growth stock. Over the past 10 years, Amazon stock generated returns of approximately 32% per year. But for income investors, Amazon may not be an attractive option due to the lack of a dividend payment.

À quelle fréquence Amazon verse-t-elle un dividende ?

Amazon, on the other hand, has never paid a dividend. The company’s promise to investors has instead been built around the idea that as Amazon grows, eats up business in new markets, and starts generating meaningful profit, investors will get more excited about buying the stock, pushing the price up.

Qu’est-ce que Nike fait de bien ?

Nike is good at lots of things: manufacturing high quality and good-looking shoes; designing fashion or professional apparels; sponsoring lots of sports teams; and making tons of money. … Nike dominates the sports gear industry because of their brilliant branding strategies.

What is Nike’s competitive advantage? Henceforth creating better customer value compared to companies. Nike has a unique competitive advantage which is the Nike Sport Research Laboratory (NSRL). Nike creates shoes that lessens the impact on the environment while not obstructing the athletes to release their fullest potential with the shoe.

Qu’est-ce que Nike a de spécial ?

Nike is good at a lot of things: manufacturing quality shoes; supplying equipment and gear for many professional and collegiate athletic teams; and making a ton of money. But where the company truly excels is its marketing. Nobody does branding quite like Nike.

Quelles sont les bonnes choses que Nike a faites ?

How We’re Doing

- % renewable energy in owned or operated facilities.

- 99.9. % footwear manufacturing waste diverted from landfill or incineration without energy recovery.

- % reduction in freshwater used in textile dyeing & finishing, exceeding target by 10 percentage points.

- % compliance with Nike Restricted Substance list.

Pourquoi Nike a-t-il tant de succès ?

Every brand needs what marketer’s call ânoticing power.â Nike is successful because they have their iconic catchphrase and celebrity endorsements. This power has the ability to grab people’s attention, make the product stand out, and rise above the competition.